The smart Trick of Esg Technology That Nobody is Talking About

Wiki Article

Esg Fundamentals Explained

Table of ContentsSome Known Facts About Esg.Some Ideas on Esg Investing You Need To KnowRumored Buzz on Esg SustainabilityThe 15-Second Trick For Esg Strategy

Why do certain financial investments execute much better than others? Why do particular startups appear to constantly outshine and be successful of the associate? The solution has three letters, as well as it is Whether you are an investor or a business, large or small - Environmental, Social and Administration (ESG) coverage and also investing, is the structure to capture on if you want to keep up to speed up with the market (as well as your expense) - ESG.Now, allow's study the ESG subject as well as the great relevance that it has for firms as well as financiers. To aid investors, financial institutions, and also business recognize better the underlying requirements to execute and also report on them, we created a. Download and install the form listed below and also gain access to this unique ESG resource free of cost.

The practice of ESG spending started in the 1960s. ESG investing advanced from socially responsible investing (SRI), which omitted stocks or entire industries from financial investments connected to business operations such as tobacco, weapons, or products from conflicted regions.

It imposes necessary ESG disclosure commitments for possession supervisors as well as various other monetary markets individuals with substantive stipulations. A substantial plan objective by the European Union to promote sustainable investment across the continent. Components of it work from March 2021. The purpose is to reorient capital flows towards sustainable investment and also far from markets adding to climate adjustment, such as fossil fuels.: is perhaps the most enthusiastic text aiming to offer a non-financial overall rating covering all facets of sustainability, from ESG to biodiversity and also air pollution treatment.

Examine This Report about Esg Investing

You rather jump on this train if you do not want to be left behind. For firms to remain ahead of policies, competitors as well as let loose all the benefits of ESG, they must integrate this structure at the core of their DNA.

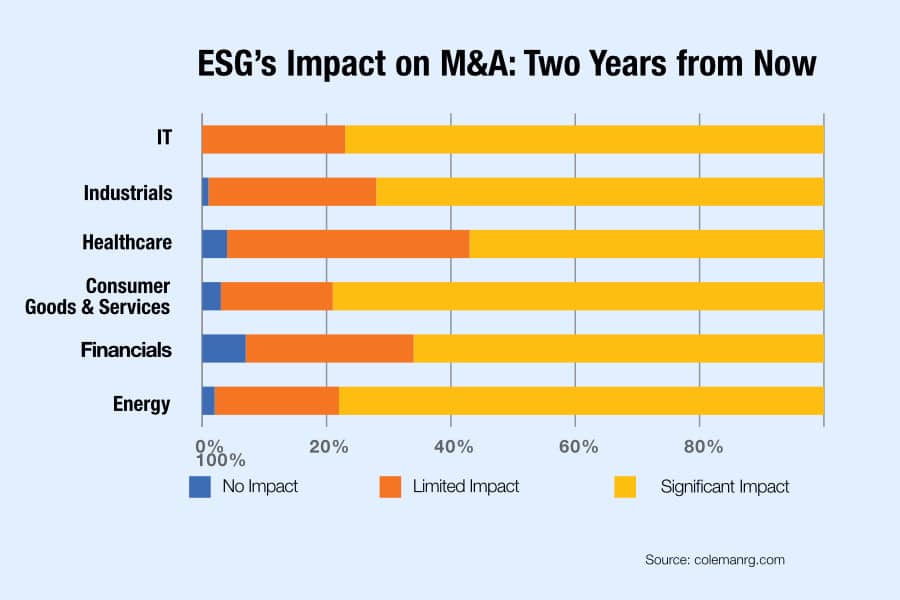

(ESG) issues are playing a boosting function in companies' decisions around mergings, procurements, as well as divestitures. How do these variables link to company efficiency and also deal potential? In this episode of the Within the Strategy Area podcast, two experts share their understandings on navigating this fast-changing landscape. Sara Bernow, who leads Mc, Kinsey's operate in lasting investing and co-leads the institutional investing practice in Europe, is a co-author of the recent short article, "Greater than worths: The values-based sustainability reporting that investors want." Robin Nuttall leads our regulative as well as government events technique and just recently co-authored "5 manner ins which ESG produces worth." They spoke to Approach & Corporate Money interactions supervisor Sean Brown at the European 2020 M&A Seminar in London, which was hosted by Mc, Kinsey and also Goldman Sachs.

Audio Why ESG is right here to remain Sara, could you start by describing what ESG is as well as why it has increased in value in M&A? ESG is rather a wide set of concerns, from the carbon dioxide footprint to labor techniques to corruption.

Not known Details About Esg Investing

Why are those 3 problems grouped together when they are so significantly various? They link with each other in the sense that the setting, the social aspects, and the extent to which you have great governance affect your permit to run as an organization within the external globe. To what degree do you handle your environmental footprint? To what degree do you improve diversity? To what degree are you transparent in your payments to a country? That has an effect on your certificate to operate in the minds of the stakeholders around you: regulatory authorities, federal governments, and also increasingly, NGOs powered by social media sites.Customers are now requiring high standards of sustainability and top quality of employment from businesses. Regulatory authorities and also policy manufacturers are extra curious about ESG since they require the business industry ESG to aid them resolve social troubles such as ecological air pollution and also office variety (ESG Strategy). The investor neighborhood has actually likewise become much a lot more interested.

So, taking an industry-by-industry lens is important and also we now see ESG-scoring firms developing much deeper industry-specific perspectives. What are a few of the crucial elements on which ESG scores have an influence? The initial concern you need to answer is, to what extent does excellent ESG equate right into excellent financial efficiency? On that particular, there have actually been greater than 2,000 scholastic studies and around 70 percent of them discover a positive connection between ESG ratings on the one hand and also financial returns on the various other, whether determined by equity returns or earnings or evaluation multiples.

Fascination About Esg Strategy

Evidence is emerging that a much better ESG rating translates to regarding a 10 percent reduced cost of capital as the threats that affect your company, in terms of its permit to operate, are decreased if you have a strong ESG suggestion. Evidence is emerging that a better ESG score converts to concerning a 10 percent reduced price of capital, as the dangers that affect your company are minimized.Report this wiki page